Enjoy the Ride - Q3 ‘23 LP Letter

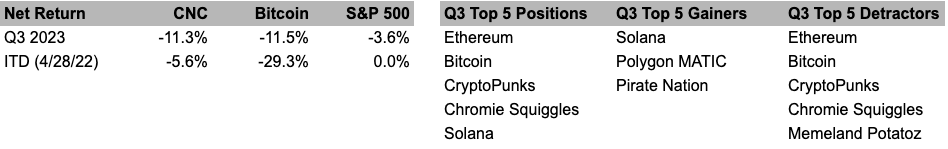

In the third quarter, the fund was down -11.3%, Bitcoin was down -11.5% and the S&P was down -3.6%. Since inception, the fund is down -5.6%, Bitcoin is down -29.3% and the S&P is flat.

The third quarter was fairly unremarkable. If you zoom out, however, the tides are shifting and we are seeing the green chutes that usher in a new bull market.

Crypto Cycles, briefly

TLDR

We’re at the beginning of a new cycle

The “Bitcoin Halving” creates a supply shock that kicks off bull markets every 4 years

Enjoy the ride

Like all financial markets, crypto is cyclical. Behavioral economics has shown that people get overly optimistic when prices go up and overly pessimistic when prices go down, creating a natural rhythm of booms and busts. This is my third crypto cycle and each cycle I am surprised at the power and consistency of the forces at play. Understanding where you are in a cycle can significantly tilt the odds in an investors favor.

“It is highly possible to improve your long-term results by adjusting your investment position at the extremes of the cycle. Not that often. But at the extremes” - Howard Marks

Determining our precise position in a cycle can be challenging, but by examining past cycles, we can make informed guesses. In my opinion, at the end of September, we have left the trough and are in the beginning of the next cycle.

Why a 4 year cycle?

The Bitcoin Halving adds structure to crypto cycles. Every 4 years the issuance of new bitcoin is cut in half, an event dubbed a “Halving”. At the end of April 2024, Bitcoin’s inflation rate will drop from ~1.7% to ~0.83%.

So what? Newly issued bitcoins are sold by miners to cover electricity and equipment costs. With the new issuance cut in half, miners have less bitcoin to sell. Unless demand for bitcoin decreases, the price must go up. This is simple supply and demand. We know that supply will decrease in the near future, and it also appears that ETFs are likely at the same time. This could become a potent cocktail.

In effect, every 4 years there is a structural supply shock for bitcoin which kicks off a boom phase. This property makes crypto cycles surprisingly consistent. Cycles in traditional markets are less predictable because they’re influenced by the actions of politicians and central banks which are inherently less predictable.

Is the halving priced in?

Source: ChartsBTC

It hasn’t been in the past. I don’t see a reason for this time to be different.

Enjoy the ride

There will be bumps along the way, but I hope you enjoy the ride. It’s the most fun part of the cycle as skeptics are scratching their head because they thought crypto was finally dead.

We don’t know what the future holds. We do know how markets tend to behave in certain environments. From here, markets tend to go up.

Source: Sigil Fund

Happy Holidays