Investor Letter - Q2 ‘22

Crypto Native Capital Partners,

I want to formally welcome you all to this partnership. I have the job of managing a portion of your savings and I am honored by your trust. Crypto Native Capital was founded on the belief that we are in the early innings of the proliferation of crypto, representing a once in a generation technological shift towards decentralized protocols and wealth creation opportunity.

In Q2, the fund was down 7.2%, the S&P was down 9.3% and Bitcoin was down 47.8% (note: time period is from inception on April 26th to end of Q2). This represents the worst quarter for the S&P since 2008 as inflation rages to its highest level in 4 decades and crypto suffers its first credit crises.

A bleak market backdrop is an excellent time to deploy capital. These events have washed out the excesses of the past decade in both traditional markets and crypto and will set a stable foundation for markets for the next decade. There were and continue to be opportunities to buy high quality digital assets at distressed prices.

Q2 ‘22 Returns

Market Review

The 2nd quarter was tough for all asset classes as the Fed started tightening monetary policy and hiking interest rates to fight inflation. While crypto is not historically correlated with equity markets, the market pullback impacted the crypto markets, as riskier, growth asset classes have substantially underperformed the broader market.

Source: Pantera

The decline in asset prices sparked two main events in crypto: the implosion of the Terra Blockchain and the liquidation of Three Arrows Capital (3AC) and subsequent credit crises in centralized, venture backed crypto companies.

“It’s only when the tide goes out do you discover who is swimming naked” - Warren Buffett

Terra

The Terra blockchain implosion wiped roughly $60b in market capitalization, the same as Lehman Brothers when it collapsed, as their algorithmic stablecoin scheme proved unsustainable when the market turned.

Terra had two main tokens, LUNA and a US dollar pegged token, UST. The UST peg was maintained using a redemption process with LUNA: when UST was below $1, you could remove $1 of UST from circulation to create $1 worth of LUNA, and vice versa when UST grew above $1, you could remove $1 worth of LUNA from circulation to create $1 of UST. The fatal flaw in this system was that it required confidence.

LUNA and UST eventually suffered the same fate as all algorithmic stablecoins before them, a death spiral. They essentially tried to print dollars out of thin air using unsustainable incentives and pounded the table with conviction to get folks on board.

The key takeaway from the Terra collapse is that not all stablecoins are created equal. Some, like USDC, are fully collateralized off-chain with US dollars held in a back account with monthly audits. Others, like DAI, are over collateralized by assets on the blockchain (i.e. ethereum and bitcoin). UST was neither, and like all previous attempts at a stablecoin with no backing, it failed.

Additional reading: Matt Levine on Terra, Paradigm LP Letter

Three Arrows Capital Contagion

One of the largest funds in the space, Three Arrows Capital (3AC), suffered a ~$200m loss from Terra’s collapse. 3AC used Terra as collateral for loans so creditors came knocking with margin calls 3AC couldn’t meet and a vicious cycle of cascading liquidations ensued.

Contagion spread from 3AC to their creditors who were caught blindsided with extremely poor risk management. These centralized quasi banks took customer deposits in the form of crypto and US dollars and promised unsustainably high yields (5-10%) in return. When 3AC collapsed, Voyager Digital and Celsius halted customer withdrawals and declared bankruptcy while venture backed BlockFi - recently valued at $4B - sold for a reported $25m to FTX. Any and all collateral held on margin was sold to cover losses, applying further pressure to the system through cascading liquidations. In short, there was significant forced selling across many funds and companies to shore up balance sheets.

These events exposed poor risk management by these centralized entities. There are currently $3.5b in claims by creditors seeking to liquidate the remaining assets of 3AC. It’s interesting to note that the DeFi (Decentralized Finance) protocols have come out unscathed and have yet to suffer losses. In fact, they’ve been the first to be paid back. There isn’t anyone to call up at the DeFi protocols to say “trust us, we’re good for it”. Instead it’s a smart contract that has strict rules and doesn’t make exceptions to collateral requirements.

Additional reading: Crypto Collapse deep dive

The Crypto Native Capital response

Source: TradingView

Crypto Native Capital was launched days before Terra collapsed. Despite the drawdown, on-chain data suggested that there was still significant leverage in the system. While waiting for the contagion to move through the system, I spent May and early June conducting due diligence on projects, challenging past assumptions, identifying over sold assets and begin to dollar cost average in to positions.

Soon after the Terra collapse, 3AC rumors started circulating. Shortly after the liquidations started and fear took hold of the markets. Is the global economy going to crash? Is crypto finally dead? Did the experiment fail?

Contrary to what you may be seeing in headlines, this has been a typical crypto pullback. In a crypto bear market, BTC and ETH pull back 70-80% - which is what we saw in Q2.

Source: Glassnode

Once the forced selling stopped and the crypto markets stabilized at the end of June, the fund became more aggressive building positions in high quality digital assets. While it’s impossible to time the markets, indicators pointed towards a bottom with leveraged flushed from the system and forced sellers exhausted. By the end of June, the fund had deployed 35% of capital.

While this letter is focused on Q2, I will provide a brief update on Q3. I pulled forward my deployment cadence to take advantage of distressed assets. In the first few weeks of July, the fund was fully invested. The market was at the point where time in the market would likely outperform timing the market.

Select New Investments

Ethereum

Ethereum, originally conceived by Vitalik Buterin in 2013 to extend the functionality of Bitcoin beyond money, is the largest and most used smart contract blockchain. The popular applications in DeFi and NFTs are most likely to be found on Ethereum. These emerging applications are starting to show what’s possible with a decentralized world computer and a global settlement layer.

The most significant upgrade in Ethereum’s history, “The Merge”, is scheduled to happen this Fall. The merge will switch Ethereum’s consensus mechanism from proof of work to proof of stake and lay the foundation to scale Ethereum significantly. The switch to proof of stake has a few desirable properties: Ethereum will become yield bearing, reduce token emissions by 90% and reduce energy consumption by 99.9%.

Source: dataalways

Ethereum holders will be able to stake their ETH to earn a 5-10% return for securing the network. Token issuance will drop 90% from ~13.3k ($21m) ETH per day to 1.6k ETH ($2.6m) and will be net deflationary as most days more than 1.6k ETH is burned from network usage. This will remove ~$21m of daily sell pressure from the ETH token. To put this in perspective: Bitcoin halvings which happen every 4 years and have historically ushered in dramatic price increases reduce issuance by 50%. The Merge reduces issuance by ~90%.

Lastly, energy consumption will be reduced by 99.9%. Not only is this a huge win for our planet but it removes one of the largest objections for user and investor adoption. These structural forces will serve as a major tailwind for the price of ETH in the coming months and years.

CryptoPunks

Source: cryptopunks.app

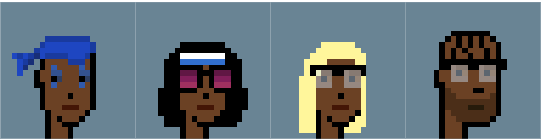

Cryptopunks, one of the earliest examples of a “Non-Fungible Token” (NFT), are 10,000 unique collectible characters on the ethereum blockchain that inspired the modern CryptoArt movement. They were released for free in 2017 as an experiment at the intersection of digital scarcity, collectibles and art and have since inspired nearly all NFT collections.

Crypto Native Capital CryptoPunks

The fund purchased 4 CryptoPunks with an average purchase price of $78k. $78k!! for a jpeg, really? Believe it or not some of the rarest types (aliens and apes) of CryptoPunks have sold for astounding sums, including an alien for $23.7m, and two apes for $7.5m each. The floor price, or the cheapest item in the collection for sale grew from a few cents in 2017 to an all time high of $450k over the past year.

What makes these NFTs valuable? There are a few lenses I find helpful to showcase the significance of the collection.

Provenance: Punks inspired the ERC-721 token standard and are widely seen as the most important NFT collection in history. That is never going to change. NFTs have been around less than 5 years and there are likely less than 2 million NFT owners. In 10 years, when many millions or even billions of people own an NFT, they will all know what a CryptoPunk is.

Digital Identity: We are spending more time online (~7 hours per day) and punks have become the ultimate status symbol on the internet. There’s an innate human desire to “flex” - to show we have good taste and that we can afford certain luxuries in life. A CryptoPunk inhabits the intersection of wealth, culture and technology.

It has a similar effect to wearing a Rolex. Yes, it is different as there is no physical item associated with buying an NFT. Yet, there is still a desire to own something expensive, rare and instantly recognizable in the digital realm. What changes when a flex becomes digital? Increased reach and easy verifiability thanks to the blockchain. Instead of 10’s of people seeing your Rolex daily, it’s now hundreds to millions of impressions per day. This sets up the dynamic where perhaps it’s more than 100x more effective as a “flex”.

To put the Rolex market in perspective, there are roughly 42m watches in circulation and the supply is growing at ~1m per year. There will only ever be 10,000 CryptoPunks.

Digital scarcity: CryptoPunks are first and foremost an experiment in digital scarcity. Below are a few questions that a punk owner put forth in his twitter thread on why they spent $7.2m to buy an alien CryptoPunk.

How large is the global demand for scarce assets?

How likely is it that the most valued assets are digital?

How likely are the first NFTs to be viewed as the scarcest?

One of the most interesting aspects of NFTs is that they are priced in ETH. Punks serve as one of the first native Ethereum economies. It’s incredibly hard to find assets that have outperformed ETH and punks have done so handedly. I think a significant reason for that is because price is denominated in ETH and not dollars.

Additional reading: Podcast with the founders, Why a VC fund spent $3.31m on a punk, CryptoPunks as a flex, Why Peruggia spent $7.5m on a punk, Twitter thread

Solana

Solana is a layer 1 smart contract blockchain. Unlike other layer 1 blockchains, such as Avalanche and Binance Smart Chain which are simply forks of Ethereum, Solana is built from the ground up with a novel consensus mechanism focused on scaling. Solana can currently handle 65,000 transactions per second vs 30 for Ethereum (Ethereum has a plan post merge to scale this up dramatically) and 7 for Bitcoin.

Blockchains face a defining question summed up in the The Scalability Trilemma which states that there are three properties a blockchain can try to have: scalable, decentralized and secure. The catch is that a blockchain can only have 2. Solana makes an explicit trade off in decentralization by increasing the hardware requirements of validators in order to increase scalability. Ethereum in its current state sacrifices scalability for decentralization and security (post merge, Ethereum has plans to dramatically increase scalability).

Solana is often called an Ethereum killer. I prefer to think that they’re complimentary. Applications can choose what blockchain best suits their needs whether that be quick throughput, decentralization or security. For example, applications that require many cheap transactions such as high frequency trading platforms, derivatives exchanges, games and more may find Solana to be an attractive blockchain to build on.

Additional reading: Packy McCormack deep dive on Solana

Convex

Convex is an aggregator for Curve, one of the largest decentralized exchanges on Ethereum with ~$7b in deposits. Curve grew its liquidity through reward incentives with its native token, CRV. Liquidity providers (LPs) earn CRV rewards for depositing tokens in Curve. To encourage LPs to hold the coin, they created a staking mechanism. CRV token holders can lock their tokens in the protocol (for 1 to 4 years) to receive a share of trading fees, boosted rewards and can vote on how rewards are distributed between pools via veCRV.

Convex improves Curve in two fundamental ways:

Convex created a liquid version of veCRV that lets holders earn platform fees without having to lock CRV for 1-4 years

LPs get higher rewards with boosted CRV rewards plus CVX (Convex’s native token) rewards

These incentives have attracted nearly half of circulating CRV to be locked in Convex. As Convex’s CRV holdings increase, so does the APY for Curve LPs and platform fees, creating a virtuous flywheel.

CVX holders receive two income streams: platform fees as cvxCRV and ~25% APR from bi-weekly payments from incentives to increase CRV rewards for specific pools. Who pays the ~25% APR to Convex holders? Protocols that want to increase the liquidity for their token.

CVX is one of the few DeFi tokens that has outperformed ETH since the tokens inception. CVX has clear utility, value accrual, and thoughtful initial token distribution and emissions schedule. While these properties may sound like table stakes, it’s rare to find them in DeFi.

Additional reading: Curve Wars, Tokenomics, Delphi Digital

Conclusion

Beyond the doom and gloom headlines that dominated crypto news in Q2, there is a large, dedicated group working nonstop to make crypto accessible to the world. The upcoming Ethereum merge is the most significant protocol upgrade in the history of crypto and is scheduled to take place this Fall. Additionally, the events of 3AC and the Terra blockchain provide valuable, visceral lessons on leverage, risk management and algorithmic stablecoins that will make the crypto ecosystem stronger.

CNC was fortunate to have held a significant cash position during the market turmoil of Q2. Emerging from Q2, the forced selling and strong fundamentals has created an opportunity to buy high quality assets at distressed prices. I'm confident the brightest days for crypto lie ahead.

Drew