Q3 ‘22 LP Letter

Dear Limited Partners:

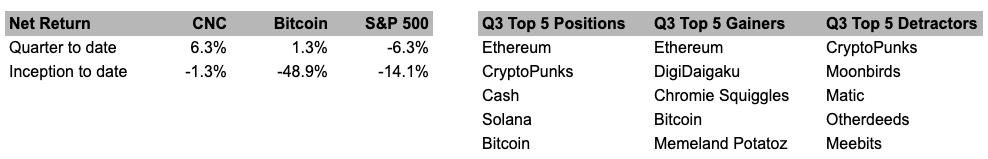

In Q3, the fund was up +6.3%, the S&P was down -6.3%, and Bitcoin was up +1.3%. Inception to date, the fund is down -1.3%, the S&P is down -14.1%, and Bitcoin is down -48.9%.

Programmable money is bigger than any group of companies or people. That’s why crypto refuses to die, despite the seemingly impossible setbacks it faces. We will look back on the bankruptcy of FTX as another footnote, although a painful one, in the long arc of crypto's history.

A few additional thoughts on what has transpired since the FTX note from last week:

Genesis Trading, the first crypto OTC desk, and prime brokerage halted customer withdrawals and is seeking $500M -$1B in funding to avoid bankruptcy. Genesis was the gold standard in crypto lending. Every company that was tangled in the web of lending is being flushed, even those that were thought to have good internal controls.

What do the companies and funds that went bankrupt in the last 6 months have in common? Leverage. As Howard Marks puts it: Volatility + Leverage = Dynamite.

The Crypto Native Capital investment thesis is simple. We buy high-quality digital assets and hold them for the long term. We do not short and we do not use leverage.

Blockchains as Cities

The word “Blockchain” first appeared in 2008 and has made people scratch their heads ever since. Why? Blockchains are a novel and complex concept requiring a new vocabulary. This technological complexity, while interesting for some, is irrelevant for long-term adoption. The average internet user has no idea what the HTTP protocol is nor how it works. I expect that is how it will be for blockchain.

While I hope that these letters expand your understanding of blockchain concepts such as consensus mechanisms and zero-knowledge proofs, I want to share a helpful mental model for blockchains that strip away blockchain-specific terminology using the United States in the 19th century.

Blockchains are best understood as cities. Cities are living, breathing organisms defined by their geography, economy, culture, infrastructure, government, and more. Cities, like blockchains, benefit from network effects. The United States in the 19th Century helps paint a picture of where we are in blockchain adoption and provides lessons on where value may accrue.

“History is all explained by geography.” - Robert Penn Warren

Philadelphia is the birthplace of the United States. In 1800, Philadelphia was the largest city in the US with nearly double the population of New York City, the nation's second-largest city. Philadelphia’s prominence was short-lived as geography limited its growth potential. Most of the world's trade was done by ship and Philadelphia is a riverport. Ships must sail 35 miles up the narrow, shallow Delaware river while fighting fast currents. This made it difficult to trade with the outside world and hamstrung growth.

New York City became America’s largest city in 1820 and rapidly became the financial and cultural center of the country. The reason for its success is quite simple: it was easier to trade in New York. New York was the closest major city to Europe. New York Harbor is a natural, deep water and well-protected port with miles of waterfront dock. The construction of the Erie Canal is what set NYC on a radically steeper growth trajectory than any other city as it connected the interior of the United States and its vast natural resources to the world. New York was simply a superior place to trade than Philadelphia.

There is a virtuous flywheel where economic activity leads to opportunities and innovation which leads to population growth. This flywheel is illustrated by the population growth of New York when the Erie Canal opened. The blockchain landscape is no different.

Bitcoin & Ethereum

Vitalik Buterin, a young programmer and founder of Bitcoin Magazine, wanted to expand the use case of Bitcoin beyond sending money. He initially sought to use Bitcoin’s scripting language to build decentralized applications on top of Bitcoin but failed. The scripting language was not powerful enough so he decided to build a new blockchain with a more advanced scripting language and faster block times. Bitcoin could not power the type of economic activity that Vitalik envisioned, leading him to build Ethereum.

Economic Activity is happening on Ethereum

One measure of a blockchain’s economic activity is the “fees” paid by users to use its block space. A helpful analogy is a city's tax revenue. Over the past two years, the majority of blockchain economic activity shifted from Bitcoin to Ethereum in 2020 as indicated by the transaction fees on each platform. Roughly 73% of all blockchain fees are paid to Ethereum.

Ethereum is buying back its land, reducing the supply

The city of Ethereum recently introduced a permanent land buyback program. When economic activity is above a certain threshold, the land is removed from circulation. Since the merge in September, there has been a net issuance of -6,000 ETH. Without the merge and the buyback program, issuance would have been 737,000 ETH over the same period. Meanwhile, Bitcoin issued 56,000 coins.

This happened as we are in the depths of a bear market. On-chain activity is depressed, yet net issuance is negative. Ethereum is the first blockchain that rewards its “land owners” via buybacks when there is more economic activity.

Buying Ethereum is like buying land in NYC in the 1800s.

Cities have network effects as do blockchain protocols. Ethereum is the most crowded, the most expensive place to live, offering the best infrastructure and opportunity. Because of these dynamics, Ethereum is where crypto entrepreneurs are innovating.

19th-century New York was also a volatile place to live. There were multiple Great Fires, gang violence, corrupt police, slums, food shortages, and more. Yet, it was a century defined by progress and historic feats of human ingenuity.

Where do we go from here? Enthusiasm and conviction in the power of cryptocurrency has only been hardened among believers. I expect continued innovation - and opportunities - around Ethereum. However, due to the recent bankruptcies and scandals, it will take hard work, sensible regulation, and new use cases to build trust and adoption.

New Investments

Chromie Squiggles

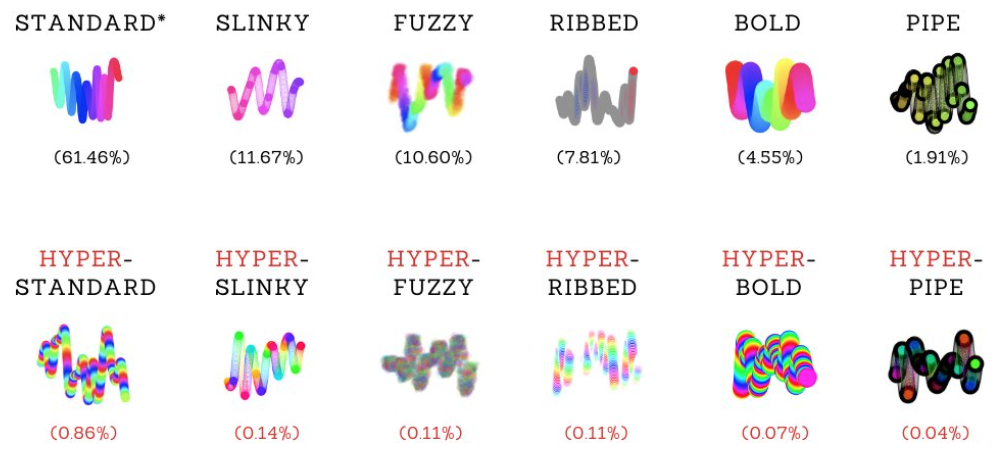

"Simple and easily identifiable, each Squiggle embodies the soul of the Art Blocks platform. Consider each my personal signature as an artist, developer, and tinkerer." -Snowfro

Chromie Squiggles were created by Erick Calderon (aka Snowfro) the founder of ArtBlocks.io, the most popular NFT generative art platform.

Chromie Squiggles are a fully on-chain, 10,000-item generative art collection. When users “mint” or created the squiggles a random seed was created and fed through the algorithm to create the squiggle. While there are trillions of possible outcomes for the algorithm - there is a 10k limit on how many can be included in the collection. This forces the artist, the creator of the algorithm, to make one that varies in type enough to create a comprehensive and interesting collection of 10k items. This is no easy task.

Chromie Squiggles have cemented themselves in the center of the conversation in generative art. As generative art grows, Squiggles will grow in recognition and value.

The market structure of Squiggles is unique in the generative art market. Most collections are 1,000 pieces and Squiggles are 10,000. This creates a larger community of collectors who work to evangelize the collection and creates liquidity. I believe that Squiggles, along with CryptoPunks, will be top of mind for traditional art collectors such as the MoMa.

Additional Resources: What’s so cool about Squiggles?

DigiDaigaku

DigiDaigaku is a collection of 2022 unique characters (NFTs) developed by stealth mode crypto gaming studio LimitBreak. The founder, Gabriel Leydon, previously started Machine zone, a multi-billion dollar pioneer in free-to-play mobile gaming. Leydon is taking his learnings from free-to-play to crypto with a free-to-own model where they give out the NFTs for free. Limit Break recently announced it had raised $200m in funding from Paradigm.

DigiDaigaku is a bet on a proven founder in a large market. Their advantage is they know how to acquire users profitably and take the view that distribution is the most important part of a game. They have the funding and knowledge to give this collection a shot at being the first crypto game with mass adoption. They’re serious about bringing users to their games, including spending $6m for a 30-second commercial in the 2023 Super Bowl. They’ve hinted that the point of the commercial is to get as many people as possible to claim a free NFT.

It’s still very early, with the entire Digi ecosystem NFT implied market cap at roughly $50m. While CNC has a nice paper gain (13x), this project has a lot of room to run. The early success of Digi also shows that new, innovative projects can see success in the depths of a bear market.

Polygon

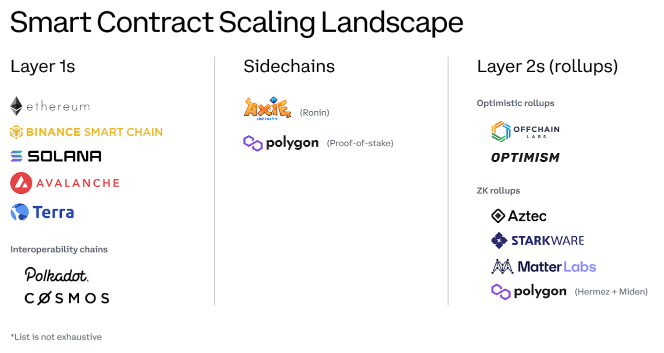

Ethereum is in the fortunate position of having significant demand for its block space. When the network is busy, transaction costs can be in the hundreds of dollars, but has the capacity for only 15 transactions per second. Ethereum needs to scale dramatically to onboard a billion people who will demand fast, cheap and secure transactions. That’s where scaling solutions come in.

Polygon is a decentralized Ethereum scaling platform with a focus on business development. The largest brands in the world, including Instagram, Stripe, Adidas, and Reddit, have chosen Polygon for their crypto offers because of the low fees, speed and integration with Ethereum. In the past few months, Reddit has onboarded over 3M wallets to their NFT offering. To put that scale into perspective, OpenSea currently has 2.3M wallets.

Source: Coinbase

The Polygon team has a pragmatic approach to scaling blockchains. Polygon’s Sidechain was the first real scaling solution for Ethereum and has become the default solution applications that require higher throughput. They have a promising pipeline to help further scale blockchains. While the underlying technology is strong, their distribution capabilities are their true differentiator. Polygon has a first-mover advantage, a team with a proven ability to ship scaling solutions, as well as a strong business development team to grow network usage.

Additional resources: Scaling Ethereum, Polygon - Ethereum’s Swiss Army Knife